Across the West, wildfires have impacted more than 3 million acres with the largest fires located in eastern Oregon and northern California. While most acres burned were concentrated in pasture and rangeland, smoke from these fires can create longer drying times for hay and in some cases impact hay color. Arizona’s alfalfa crop is in good to excellent condition, with only 3% rated as poor to very poor. However, pasture and range conditions are declining, and native forage production is forecast to drop 15-30% below the historical average. Producers may need to purchase additional hay to compensate for this shortfall and ensure their livestock have enough feed. In California’s Imperial Valley, 160,000 acres of hay and grasses have temporarily turned off their water usage through the Deficit Irrigation Program, where farmers limit water use during a 45-60 day period in exchange for compensation. Consecutive days above 100°F have hurt alfalfa quality and yields in California. In the San Joaquin Valley, hay prices were forecast to average $210 per ton in 2024. However, $210 per ton is closer to the top prices producers are receiving for early cuttings. This may serve as an early warning sign for continued weakness in hay prices for western growers. California, particularly the San Joaquin Valley, plays a crucial role in setting hay prices for the rest of the western U.S. due to its significant production and export capacity.

In Washington-Oregon’s Columbia Basin, hay quality has been good with favorable growing conditions and decent supply. Some growers have decided to plant beans following their first timothy cuttings and despite a tighter but manageable timothy hay supply. In Idaho, scattered storms have impacted some hay growers with second cuttings wrapping up, and third cutting 16% complete across the state. Anecdotally, growers have reported lower yields, especially for grasses. In Montana, hay yields are 15-30% lower than in 2023, with producers attributing lower yields to the cool, wet spring. July saw heat with several days in the triple digits and little rainfall causing 43% of the state to be in moderate or worse drought.

Alfalfa export demand is soft. Exporters have abundant supplies remaining from last year that they still need to ship. Low milk prices, both domestically and internationally, have made it hard for dairies to afford feed, resulting in reduced alfalfa demand. For export hay, this issue is further exacerbated by a strong U.S. dollar and economic challenges in east Asia. To stabilize milk prices, China plans to limit milk production, which will financially hurt dairy producers and further hinder their ability to buy hay. Export demand is expected to stay low until hay prices decrease, the U.S. dollar weakens (likely due to the Federal Reserve cutting interest rates), or a combination of both factors occurs.

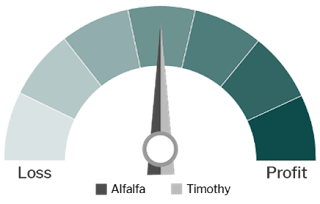

Profitability

The profitability of Northwest hay growers has been impacted by a sharp decline in hay prices. In February, the average price per ton for Northwest hay growers was $202, marking a 29% decrease compared to the previous year. While hay prices have come down, expenses remain elevated and sticky. Anecdotally, Northwest producers are selling at breakeven levels and still struggling to find buyers.

No comments:

Post a Comment