Tuesday, January 31, 2023

Hay Market Demand and Price Report for the Upper Midwest

Demand and Sales Comments

Hay market is steady to strong with drought areas having highest demand and prices for hay. Wisconsin has a good supply of forage, with lower prices for lower quality of hay. If you have questions on this report contact richard.halopka@wisc.edu. If you need forage or have forage to sell or straw, connect to the Farmer-to-Farmer website. You may contact your local county agriculture educator if you need help placing an ad. There is no charge for the service.

Straw prices are for oat, barley, or wheat straw. Straw prices are steady. Small square bales averaged $5.15 a bale (range of $3.00 to $7.00). Large square bale straw averaged $53.00 per bale (a range of $34.00 to $75.00). Large round bale straw averaged $55.00 per bale (range of $35.00 – $72.00).

In Nebraska, prices remain steady on a thin market, with steady activity.

In South Dakota, all classes of hay have a good demand with limited stocks, strong prices, with weather requiring increased hay feeding.

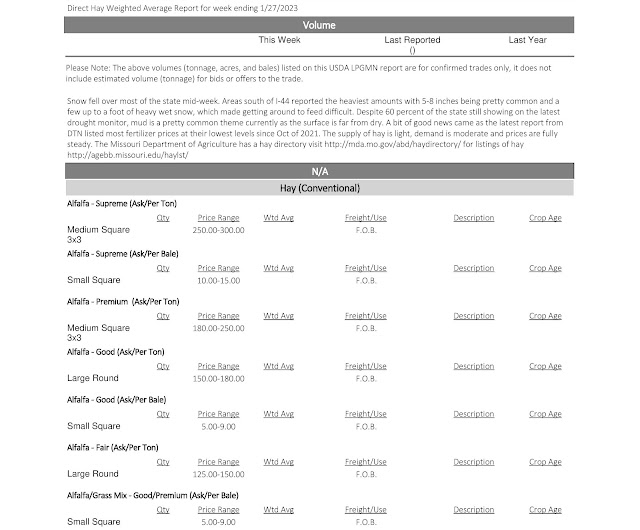

In Missouri, hay supply is light; demand is moderate, with steady prices.

In Kansas, demand is strong. Prices are steady with a lower number of trades.

In Wisconsin, prices for dairy quality hay are steady. Overall Wisconsin has a good supply of forage. Dairy hay prices are good, but lower quality may be discounted.

Friday, January 27, 2023

Thursday, January 26, 2023

Tuesday, January 24, 2023

12-month profitability outlook for hay suggests profitable returns.

Projected reductions in hay and grass production due to drought and lower national on-farm inventory supports strong hay prices in 2023. Demand from exporters and producers rebuilding hay inventories support profitable returns for hay producers.

Strengthening U.S. dollar slows trade

A strengthening U.S. dollar and rising exchange rates pose risk for hay exporters. Of the three largest hay export destinations, all have had exchange rate increases. The Chinese Yen exchange rate has increased to $6.70 Yen for $1 USD on Jan. 13, 2023, up 5.4% from a year ago. The Japanese Yen reached $127.81 Yen for $1 USD, a 11.5% yearly increase, and the South Korean Won exchange was up 8% from last year.

Hay exporters must manage the compounding effects of higher prices and exchange rate increases. Export quality hay in the Columbia Basin is trading at over $135 per ton more than a year ago. When also factoring in exchange rates, the real cost of exported hay to Japan has doubled within a year. Shipping rates, particularly from East Asia to North America, will provide some price relief after falling nearly 60% below their September 2021 peaks. Weaking exchange rates should also help 2023 hay sales. The increase in 2022 hay prices and exchange rates impacted Northwest trade with total exports through November down 7% year over year. Nationwide total alfalfa and grass exports followed suit down 7% year over year.

On-Farm Stocks Improved in Northwest, but National Inventory is Down

December 1 on-farm hay stocks for the Northwest reached 8.36 million tons, up 1.09 tons from 2021’s tight carry-overs. Improvements in drought conditions increased Montana and Oregon’s hay stocks, up 12.1% and 5.3.% year over year respectively. Despite improvements, hay supply will remain tight into 2023 as on-farm hay inventories have not yet recovered to the historic average level of 10 million tons. Water availability will be the largest factor for Northwest hay production. In areas with lingering drought, it’s unlikely producers will be able to fully rebuild depleted feed inventories.

Nationally, the December 1 on-farm hay stocks reached a low of 71.9 million tons, 10.3 million tons lower than the five-year average. This is the smallest on-farm hay stocks in 60 years (1954 was the last year with December 1 on-farm hay stocks of 71 million tons). The USDA forecasts 2023 hay and grass production down 1% and 11% respectively year over year. The primary driver for a lower hay production forecast is worsening drought conditions in the Central Plains and Southern Plains. Low on-farm stocks and less production supports sustained elevated hay prices.

Transportation Challenges

Transportation logistics are facing challenges due to a shortage of drivers and rising fuel costs. National trucking rates are now more than 50% higher than pre-pandemic levels, and trucking challenges vary by region. These challenges led the USDA to update the emergency assistance programs to assist in covering the cost of transporting hay and feed to drought-stricken areas with livestock producers. Despite this financial aid, transportation issues are contributing to higher hay prices and are likely to affect producers throughout 2023.

Hay Prices Soften in September, but Remain Strong

The October 2022 U.S. national hay price was a record $250 per ton, up $54 per ton from a year ago. The Northwest hay price peaked in September 2022 at $291 per ton. Quality hay prices in the Columbia Basin have been as high as $400 per ton. In November 2022, Northwest hay prices averaged $279, $109 higher than the five-year average. Washington and Oregon 2022 hay prices averaged $292 and $284 per ton, respectively. Idaho and Montana 2022 hay prices averaged $258 and $250 per ton, up 37% from 2021.

Profitability

Hay producers have headwinds from significantly higher pre-pandemic production expenses. The silver-lining is forecasted reductions in national hay production and continued international and domestic demand will keep hay prices elevated throughout 2023. While prices have softened from records in 2022, easier access to inputs, improvements in irrigation water outlooks, and strong hay prices will create tailwinds for hay producer profitability.

-page-001.jpg)

-page-002.jpg)

-page-001.jpg)

-page-001.jpg)

-page-002.jpg)

-page-003.jpg)

-page-004.jpg)

-page-001.jpg)

-page-002.jpg)

-page-001.jpg)

-page-002.jpg)

-page-001.jpg)

-page-001.jpg)

-page-001.jpg)

-page-002.jpg)